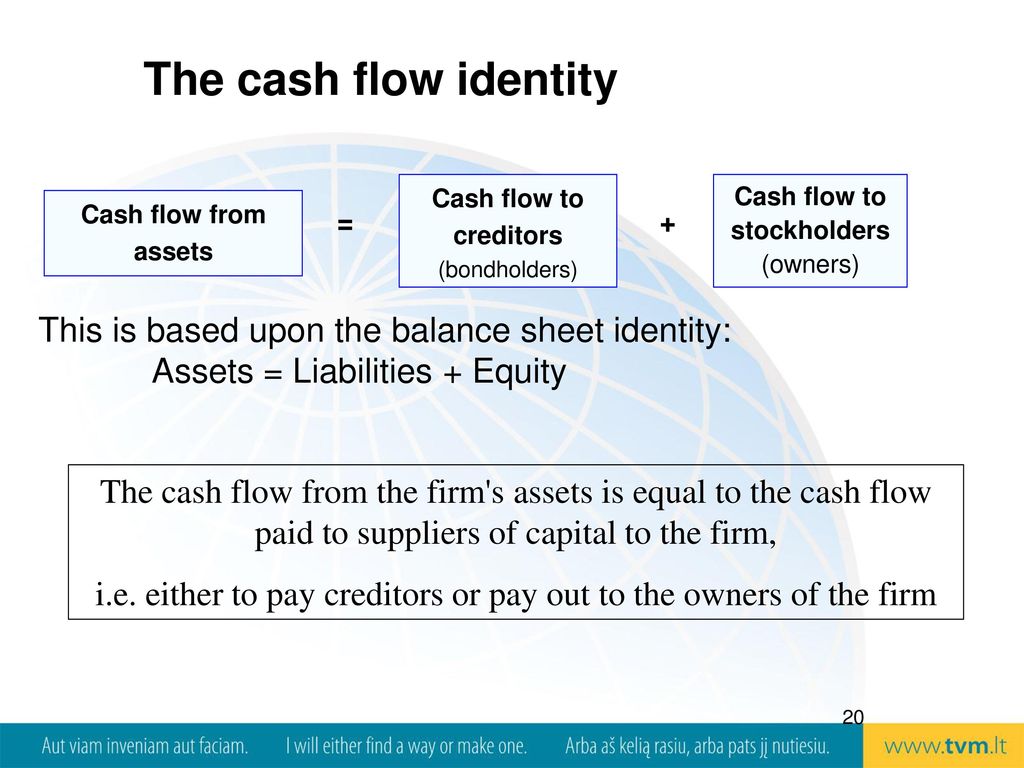

The Cash Flow Identity Reflects the Fact That

-a firm generates cash through its various activities. At the bottom of our cash flow statement we see our total cash flow for the month.

The Cash Flow to Creditors Calculator allows you to calculate the net change in a companys cash during a given period understanding your Cash Flow to Creditors is particulalry useful if you are considering taking a business loan or encouraging investors as Cash Flow to Creditors reflects your companys ability to take on additional debt or expenses.

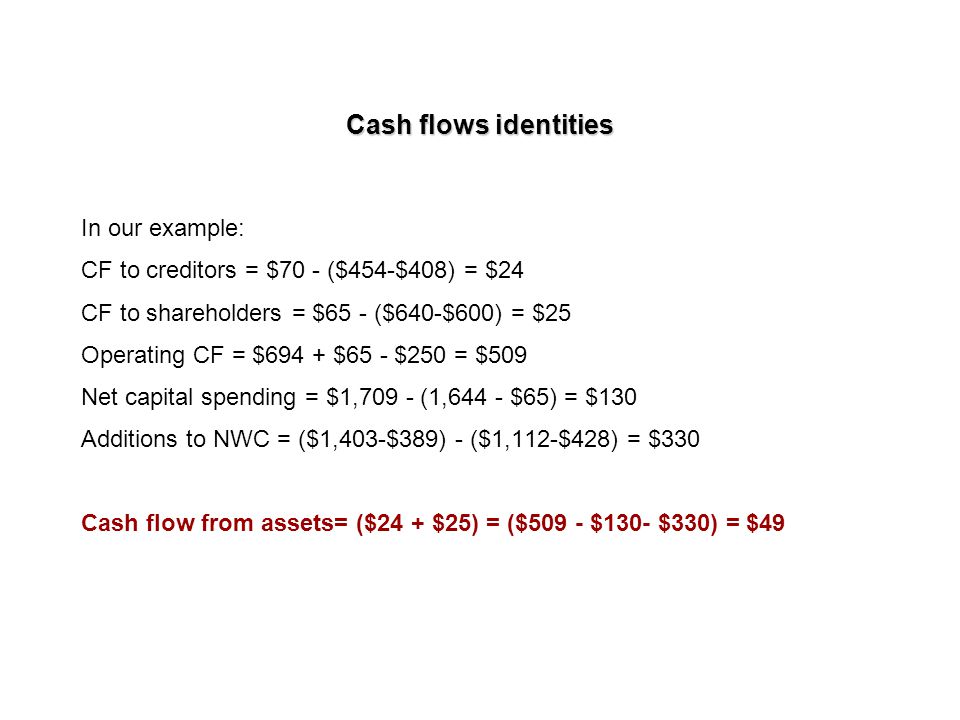

. Balance Sheet 2014 2015 2016 Income Statement 2015 2016 Assets Sales 2950 2700 Cash 1200 1100 2600 Operating Expenses 900 1090 Accounts Receivable 900 1150 720 DepreciationExp. The cash flow identity reflects the fact that. -Cash flow from the firms assets equals the cash flow paid to suppliers of capital to the firm.

In accounting finance and economics an accounting identity is an equality that must be true regardless of the value of its variables or a statement that by definition must be true. Cash flow from assets OCF Change in NWC Net capital spending. View Homework Help - Cash Flow Identity from FINANCE 6000 at Al-Sirat Degree College.

OCF 90054 60033 27531. -cash is either used to produce the product or service pay creditors or payout to the owners of the firm. The CFS can help determine whether a company has enough liquidity or cash to.

This is the third of several posts on Ken Rogoffs The Curse of CashAs summarized in an earlier post Rogoff argues that banning physical cash has two major benefits. Where an accounting identity applies any deviation from numerical equality signifies an error in formulation calculation or measurement. Cash flow from the firms assets equals the cash flow paid to suppliers of capital to the firm.

What it reflects is the fact that a firm generates cash through its various activities and that cash either is used to pay creditors or else is paid out to the owners of the firm. To construct the cash flow identity we will begin cash flow from assets. Introduction to Corporate Finance with Greg PierceTextbook.

The company recorded an annual net income of 484 billion and net cash flows from operating activities of 636 billion. This is the cash flow identity. Reduces profit but does not impact cash flow it is a non-cash expense.

Share Price Maximization FIN 6000. Thats 42500 we can spend right now if need be. Compared with the income statement or the balance sheet the cash flow statement gets perhaps the least amount of attention from everyday investors.

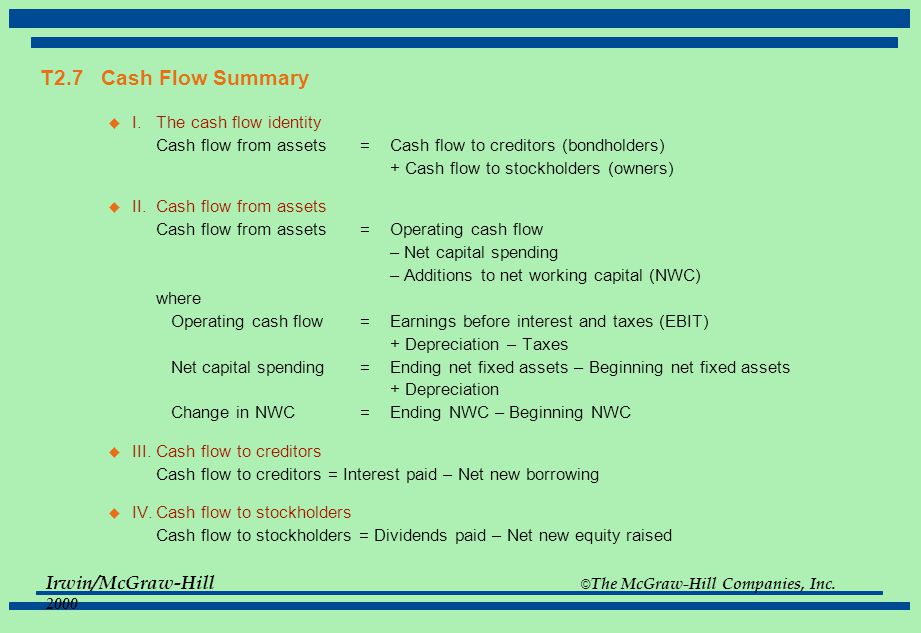

The cash flow identity Cash flow from assets Cash flow to creditors bondholders Cash flow to stockholders owners where Cash flow to creditors Interest paid Net new borrowing Cash flow to stockholders Dividends paid Net new equity raised Cash flow from assets Operating cash flow Net capital spending Additions to net working capital. 400 490 Inventory 1400 1000 1100 Operating Income 1650 1120. There are many types of CF with various important uses for running a business and performing financial analysis.

It reflects the fact that a firm generates cash through its various activities and that cash either is used to pay creditors or else is paid out to the owners of the firm. Cash Flow from Assets. Reducing crime and enabling effective monetary policy at the zero lower boundIn this post I will address the first of these supposed benefits by considering the relationship between cash and.

View Essay - TCavins - Alliant - FIN 6000 - Cash Flow Identity from FIN 6000 at Alliant International University. A firm generates cash through its various activities. -a firm generates cash through its various activities.

Cash Flow Identity FIN. In finance the term is used to describe the amount of cash currency that is generated or consumed in a given time period. Cash flow from the firms assets equals the total of cash flow to creditors and cash flow to stockholders.

Terms in this set 24 the cash flow identity reflects the fact that. Cash flow from assets is. Kelley School of Business Cash Flow Identity Problem Professor.

So the operating cash flow is. Ironically the cash flow statement can be the most telling of the three financial statements. Fundamentals of Corporate Finance Ross Westerfield JordanChapter 2.

The cash flow identity reflects the fact that. Cash flow from assetscash flow to creditors cash flow to stockholders. We discuss the various things that make up these cash flows next.

A cash flow statement is a valuable measure of strength profitability and the long-term future outlook of a company. -cash is either used to pay creditors or paid out to the owners of the firm. The term accounting identity may be used to distinguish between.

The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense Depreciation Expense When a long-term asset is purchased it should be capitalized instead of being expensed in the accounting period it is purchased in. Operating cash flow is the same as operating income. Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has.

-cash flow from the firms assets equals the total of. The cash flow identity reflects the fact that. In fact its the only financial statement that matters to many investorsHere are ten things you need to remember.

OCF EBIT Depreciation Taxes. Cash flow for the month. Cash is either used to produce or service pay creditors or payout to the owners of the firm.

A firm generates cash through its various activities. Up to 24 cash back This is the cash flow identity. Even though our net income listed at the top of the cash flow statement and taken from our income statement was 60000 we only received 42500.

After interest and taxes.

Financial Statements And Ratios Ppt Video Online Download

Pdf Cash Flow Growth And Stock Returns

Consolidated Financial Statements

Principles Of Business Finance Lecture 2 Financial Statements Prezentaciya Onlajn

/GettyImages-185257940-428b14ff299d4a1193aa1404c535ea9e.jpg)

Free Cash Flow To The Firm Fcff Definition

South Africa Detailed Assessment Report On Anti Money Laundering And Combating The Financing Of Terrorism In Imf Staff Country Reports Volume 2021 Issue 227 2021

Topic 2 Financial Statements And Cash Flow Ppt Download

Fundamentals Of Corporate Finance Ppt Download

Financial Statements And Ratios Ppt Video Online Download

Topic 2 Financial Statements And Cash Flow Ppt Download

Corporate Social Responsibility And Cash Flow Volatility The Curvilinear Moderation Of Marketing Capability Sciencedirect

Comments

Post a Comment